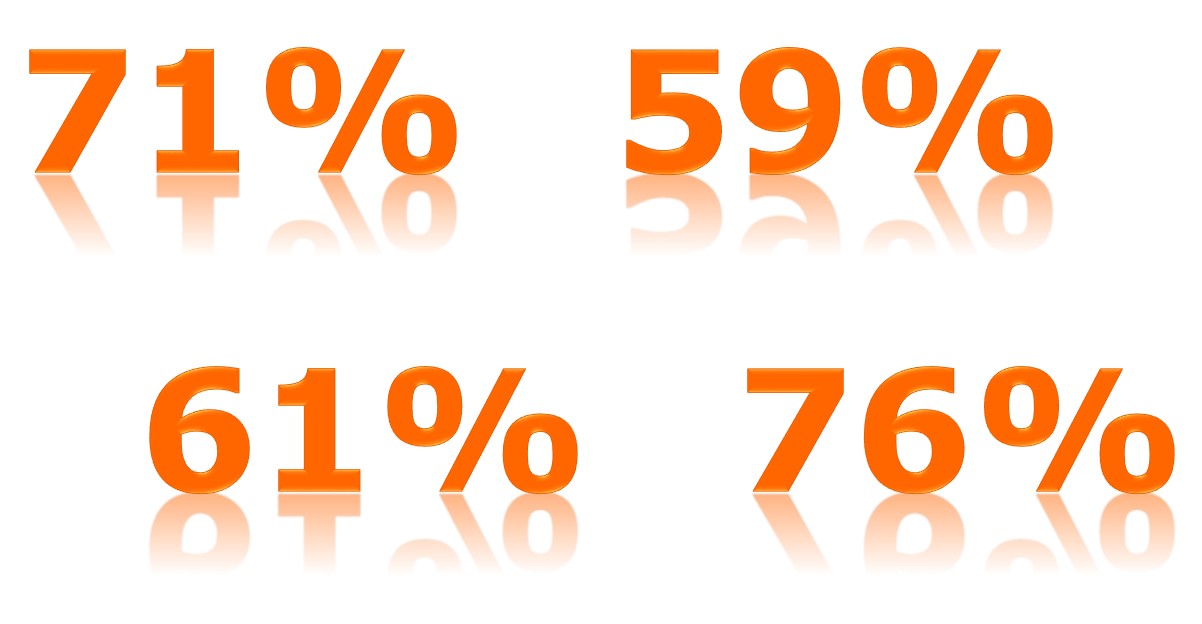

The internet and conference presentations are full of shopper data soundbites. Apparently shopper behavior can be wrapped up in simple soundbites and generic shopper data such as “24% of shoppers use their mobile when shopping”. Yet in my experience understanding shoppers, and then using that understanding to influence shopping behavior is far from simple. Doing it successfully is a nuanced blend of art and science. So beware generic shopper data: let’s think a bit harder about how we use shopper insight to drive changes in shopper behavior. But let’s not ignore generic shopper data either: it can be valuable, if it is handled with care!

The internet and conference presentations are full of shopper data soundbites. Apparently shopper behavior can be wrapped up in simple soundbites and generic shopper data such as “24% of shoppers use their mobile when shopping”. Yet in my experience understanding shoppers, and then using that understanding to influence shopping behavior is far from simple. Doing it successfully is a nuanced blend of art and science. So beware generic shopper data: let’s think a bit harder about how we use shopper insight to drive changes in shopper behavior. But let’s not ignore generic shopper data either: it can be valuable, if it is handled with care!

The danger of generic shopper data – different shoppers behave differently!

When I look at my own behavior as a shopper and compare it to, for example, my wife: what we want from a shopping trip varies dramatically. We go out shopping together and for me, a great shopping trip is over in fifteen minutes, and requires going to no more than two stores. For my wife, a trip that didn’t involve several stops, and going to places we hadn’t planned to visit to buy stuff we hadn’t planned to buy – well that really isn’t a proper shopping trip.

Same shopper, different trip? Different shopper behavior!

And then if I think more about my own shopping trips I find that my behavior varies. Often I want my shopping to be quick and simple. But put me in a music store, or a video game store, I’ll browse for hours. I’ll check reviews on my phone. I’ll check prices. I’ll go to different stores. I’ve even messaged a friend in another country to check the price there.

I met with a client who made computers recently, and we discussed their global path to purchase model. It was full of words such as ‘inspiration’ and ‘discovery’: it all sounded very plausible. Shoppers research extensively, both online and offline – the usual path to purchase stuff. Yet last time I bought a PC, my journey was quite different. I was due to go on a business trip the next day, and my PC stopped working. It was quite old, and I needed a new one anyway. I was happy with my current brand, so I bought the most up to date version of the same brand. No inspiration. No discovery. Now I’m not saying the model is wrong, but it is just that – a model.

The reality is that shopping behavior is highly varied. It depends on the shopper, for sure. It also depends on the shopper mission, on the occasion, on the store, and, quite possibly, on the weather. Which is why any reports which start with “Shoppers say…” need to be taken with a pinch of salt.

Using generic shopper data to fuel your own shopper insight!

Don’t get me wrong: the articles published with generic shopper data are not useless, but they have to be used with caution. If handled with care, however it can add value. Here is how to use generic shopper data to add value to your business.

- Consider what the shopper data actually means. The headline is written to make us think that the shopper data is significant and newsworthy. Let’s consider the ‘24% of shoppers…’ for a moment. What does it actually mean? It suggests that in any store, almost one in four shoppers are on their phone. But what it actually means is that 24% of shoppers claim (not did, claim) that they have used their phones, in a shop, at least once, in a certain period of time (probably a month, or longer). Think about how many shops you’ve been into in the last month, and how many things you’ve bought. The significance of the fact that you’ve used a phone once in that time depends greatly on how many shopping trips and how many purchases you’ve made. If the average shopper has been on 10 shopping trips and bought 50 items, then 24% of shoppers could become 0.5% of shopping decisions. Quite a difference, as you can imagine.

- Consider whether these shoppers might be your target shopper. For every tech hungry shopper there is a traditionalist. Different shoppers do different things. The 24% is only interesting if you are targeting that 24%!

- Consider how this might vary by channel. Think about what you know about how your shopper behaves in your category and channel. All of this data is hopelessly generic. Even if we accept a 24% number for a moment: is it the same across categories? Of course not! Channels? Don’t be silly! But that doesn’t mean the behavior isn’t happening.

- Consider your objective. What actually do you want your shopper to do? Let’s suppose your shopper, in your category, and in the channel you are targeting, does like to look at their smartphone. While that’s a good start, it doesn’t mean that mobile is the best media for you. What is it you want the shopper to do? Try, buy more, switch brands, enter your category for the first time? The fact that a shopper is prepared to use a particular media is merely data: the skill comes in deciding whether that media is going to be effective given your goal.

- Use the soundbite to generate a series of hypotheses about your target shoppers. What if they behaved like this? Which channels might this behavior happen in? If it did happen, how might you use it to generate changes in shopper behavior.

- Prioritize these hypotheses based on the potential value to your business, and whether you would be able to act on them if they were proved. Hi tech solutions are great, but if they don’t add value, or implementing them would be too expensive, then let’s drop them now.

- Once you have these hypotheses, review any existing data you have to seek support for those hypotheses (or indeed anything which would disprove them). If nothing exists, seek to research these if they are valuable enough, or potentially seek an opportunity to test them at retail.

There are no shortcuts in shopper marketing as there are no shortcuts in any marketing. The more you understand your shopper, how they behave, and how they can be influenced, the better. That is the heart of shopper marketing, and it lies at the heart of what we share in our workshops. If you want to learn more about the real art and science of shopper marketing, I hope to see you soon!