The consumer goods industry has been sleep-walking towards the edge of a cliff for some time. Too many brands and too many retailers have simply been too internally focused, or too comfortable with the cosy status quo to notice that the world around them is changing. Of those that have noticed, a few have begun to respond, but many are stuck like rabbits in headlights, or trapped in the glue of inertia and current ways of working. In the last twelve months a number of significant pressures have come to bear to create a perfect storm – a storm which may wash away a few retailers, and a lot of brands including one or two surprisingly household names. Marketing Directors, CEOs, Sales Directors and Brand Managers – is your brand about to die, and what are you going to do about it?

The consumer goods industry has been sleep-walking towards the edge of a cliff for some time. Too many brands and too many retailers have simply been too internally focused, or too comfortable with the cosy status quo to notice that the world around them is changing. Of those that have noticed, a few have begun to respond, but many are stuck like rabbits in headlights, or trapped in the glue of inertia and current ways of working. In the last twelve months a number of significant pressures have come to bear to create a perfect storm – a storm which may wash away a few retailers, and a lot of brands including one or two surprisingly household names. Marketing Directors, CEOs, Sales Directors and Brand Managers – is your brand about to die, and what are you going to do about it?

Shoppers are changing, and that is changing consumer goods

Shopping behavior is changing. As detailed here, the rise of the internet together with recessionary pressures, has led to a fragmentation of shopping baskets. A three-decade trend towards one-stop-shopping is being reversed. The impact that is having on retailers has been well-documented, but the impact it has on manufacturers and brands perhaps less so. But if you thought your brand was somehow going to be immune to all this, the recent announcement by UK retailer Tesco that they would be culling ranges at a huge scale. We already see Private Label share growing at the expense of brands. Range reviews like this will surely become more common as retailers attack the inventory (the largest controllable cost in the business). But the pressure that will hit brands will be much greater.

Grocery brands will come more retail pressure

Large retailers know that they need to change and adapt, and that will typically require investment. Store renovations, investment in setting up online retail operations, investing more in data and technology to attract shoppers and better understand them. Cutting prices to combat the sweet price points that hard discounters and online merchants can offer. All of this requires funding, and retailers have two sources of funds. Their shoppers (and that one is reducing, hence the problem) and their suppliers.

Brand manufacturers will come under the cosh to pony up and pay their way. We’ve already heard of pressure from retailers on suppliers to cut prices. And suppliers have to find all this extra cash at a time when sales are already under pressure due to the cost of living.

Consumers and shoppers are discovering new grocery brands

At the same time, smaller niche players, emboldened by the marketing and distribution power that the internet gives them, are rapidly identifying and filling niches that larger brands have ignored. Take a look at some of different aisles next time you do a store visit. Check out the spirits aisle, for example or beer, or even snacks; where you’ll see a lot of smaller players taking space that used to be held by the major players. With their core retail business profitability under threat, and new competitors opening up all around, brands are increasingly becoming beleaguered.

Why aren’t grocery brands better prepared?

How is it that so many once-great, household brands are now finding themselves crushed between retail customers that they can’t control and smaller-scale competition? It appears to me that there are a number of key causes, but one of the biggest is that they have focused too much on keeping retailers happy and not enough on consumers and shoppers.

The death of the grocery brand

A steady downward cycle has been at play for at least the last quarter of a century that I have been working in the industry. It goes something like this. Big retailers demand more, because of their scale. Grocery brand owners pay a little more. Retailers use this advantage to cut prices, which helps them take more share, and allows them to demand more from manufacturers. Manufacturers compensate for the increased costs in funding retailers by cutting down on brand marketing and innovation. They invest in discounts and price promotions to prop up sales volume. Brands then begin to lose meaning and differentiation, as they become more dependent on price. The innovation gap narrows making meaningful private label more accessible for retailers. Brands lose their relevance with consumers and shoppers and exist merely because of the funding to retailers and heavy discounting. Brands can survive for years in this coma state, until retailers finally call time, or until someone comes along and simply markets better.

How to save your brand

The answer isn’t digital marketing or big data, though both of these will help. It isn’t a restructure or the establishment of a shopper marketing function, though these might be necessary. The answer is far simpler than that. Peter Drucker once said that business was only two things: marketing and innovation. It is marketing and innovation that will save brands again.

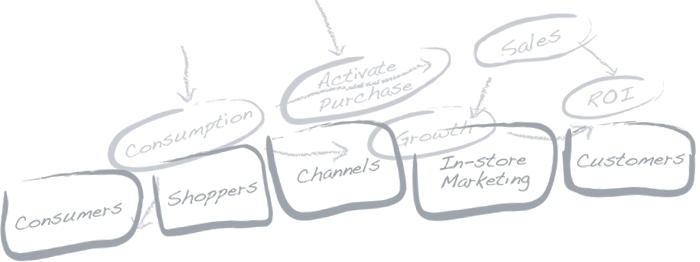

Grocery brands must remember that marketing is about seeing the world through the eyes of the customer, and that a grocery brand has three customers. There is the consumer, the shopper and the retailer. Brands must deeply understand them, and create meaningful relationships with each that add value to each and are elevated far above transactional.

And this does require a shift in the way we do business. It requires different insights. It requires ways of working and processes that reflect the ‘three customer reality’. It requires new skills and behaviors.

And this is what I mean by innovation. I’m not limiting my definition of innovation to new products, but innovating on a daily basis, looking at the world differently, but always in a way which brings value to one or all of those three customers.

If you’re a brand owner, a marketer, CEO or a sales leader and, after reading this, you are feeling just a little uncomfortable – don’t panic. To get started on the road to ensuring your brands will thrive in this challenging environment, get in touch now for a clear plan of what you need to do next.

Image: Flickr