Oh Tesco, where did it all go wrong? There was a time when Tesco were on top. Shoppers loved them; their lovely stores and heartwarming, funny adverts. They were the darlings of the city. Even suppliers – well perhaps suppliers didn’t love Tesco exactly, but they were respected and seen as one of the better retailers to get close to. They were progressive. They were the future of retail. Where did they go wrong? They lost their focus on the shopper. They ceased to use their investments to create customer value. So what can we learn from this?

Shopper Marketing is about creating customer value

Back in the day, Tesco were shopper marketing pioneers. Tesco built a brand. The “Every Little Helps†campaign encapsulated more than a catchy tagline; it was the brand essence that was built into everything. Campaigns talked of Tesco going further (as in these classic TVC featuring Dudley Moore chasing chickens) in their goal to make life a little better. It was understated, and brilliant.

Tesco pioneered what was one of the first, biggest, and longest lasting Corporate Social Responsibility campaigns (almost certainly before the term CSR was coined) with their “computers for schoolsâ€. They were the good guys. ClubCard was launched, a pioneering loyalty card which promised further ‘little rewards’ supporting the ‘every little helps’ message. Everything was about creating extra customer value.

And then it started to go wrong. Tesco appeared to lose sight of pretty much everything apart from the city. Growth and profit is not a bad goal for a corporation, but it comes from marketing effectively to the customers. The irony of Tesco is that, with all that shopper data from Clubcard, they failed to use that customer intimacy to drive anything more than deals. They failed to add customer value.

Every Little Helps morphed into an advertising tagline, more and more focusing on discounts and deals. Staffing levels in stores were reduced as cash was funneled into more stores in the UK and abroad. Tesco focused on price, range and convenience, because that is what they thought their shoppers wanted.

Really?

Shopper marketing is about looking at the world through the eyes of shoppers

Tesco’s model became about real estate, not customer value. And not just buying it: selling it. The big retail model is a balancing act: attract shoppers, and then charge suppliers for the privilege of putting products in front of shoppers. A model that works only if the cycle is virtuous. Build great stores in great locations; pack them full of products that people want, at prices they like, and away we go.

But stores get bigger, and the pressure is on. As Herb Sorensen shows here, the bigger the store, the less space is shopped. All that real estate investment adding no customer value. As more and more stores open, the additional shoppers that each brings is smaller. The returns in terms of shoppers gets lower. But that’s OK for retailers: they have other sources of profit. They continue to charge suppliers a premium to put the product in their stores, and suppliers continue to pay, until…. Until.

Until someone says stop. Until suppliers stop paying. Until shoppers realize that Tesco actually don’t create a great shopping environment. Until shoppers see that the stores are overly complex full of products that not enough people want. Until other retailers come along with an offer which much more closely meets the needs of shoppers. Until suppliers question the returns they get from investing in Tesco.

Herb Sorensen highlights the problem. The vast majority of product in a modern superstore isn’t seen by most shoppers. Most of the floor space, expensively acquired by retailers isn’t visited by shoppers. Most of the products simply aren’t relevant. Shoppers are paying a premium; as are suppliers – for stores and inventory that nobody needs – that create no customer value.

I was in Tesco store in Dublin recently, which coincidentally had an Aldi, and a Lidl nearby. The Tesco store was quite an old one, and looked it. It was (like much of Tesco’s retail stock) a cold, emotionless warehouse. The Aldi and Lidl stores were hardly fabulous retail environments, to be fair, but they were fine. And that is the point. Why is the shopper asked to pay a premium for shopping at Tesco? The retail environment was comparable, and certainly not significantly different.

And how about range? Aldi seemed to have a simple strategy: shelves are dominated by private label, but the leading brands for most categories were there. For sure, there may be some categories that the range might, for some shoppers, be too tight, but for the majority of people they have what are required. Tesco? Tesco is range crazy. An example? Take a look at the image. This is shaving foam and cream. There are seventeen items in the range for Tesco. Aldi had two. Now I shave as often as most guys, and I’ll be honest – I really don’t need a range of seventeen products to choose from! Up to fifteen of those items drive cost into the value chain, but no customer value at all.

And how about range? Aldi seemed to have a simple strategy: shelves are dominated by private label, but the leading brands for most categories were there. For sure, there may be some categories that the range might, for some shoppers, be too tight, but for the majority of people they have what are required. Tesco? Tesco is range crazy. An example? Take a look at the image. This is shaving foam and cream. There are seventeen items in the range for Tesco. Aldi had two. Now I shave as often as most guys, and I’ll be honest – I really don’t need a range of seventeen products to choose from! Up to fifteen of those items drive cost into the value chain, but no customer value at all.

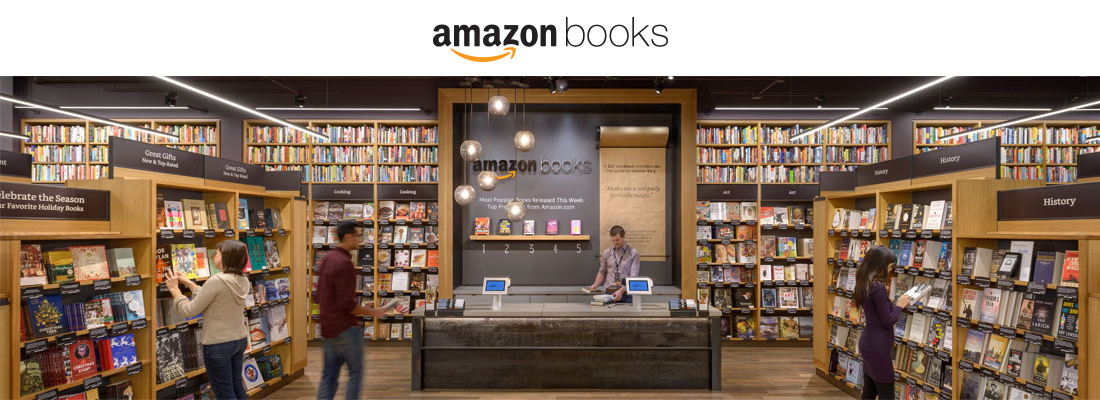

Shopping has changed, and Tesco and many others have missed it

, going back to the way they used to be. Supermarkets created the ‘one-stop-shop’ and technology is destroying it. Shoppers seem to have got used to shopping in several stores, and online, and seem to prefer that experience. Shoppers can pick up their basics at Aldi or Lidl – buying the categories they need, where they don’t need a selection. Some can be picked up online, or even via a subscription.

Perhaps shoppers continue to shop at the ‘one-stop-shop’ – but they spend less. Shopping trips fragment further. Shoppers can use online – not just for convenience or price, but to access specialists who can give them ranges in selected categories, that the big box retailers can’t compete with.

The Shopper Marketing Revolution

And what we see is “Big Retail†stuck, and hit hard in two dimensions. Traffic per store isn’t growing – partly driven by supermarket saturation, and partly because of discounters and online. At the same time, basket size is declining – driven by the fact that more and more categories are being picked off by specialists and discounters. All of this is just killing the model that was broken for a very long time.

What can we all learn from this? That investing in things that your customer doesn’t value is doomed. That if you take your eye off the consumer, the shopper, your customer, for just one moment, you can lose. That focusing on profit rather than customer satisfaction is a road to ruin. We are facing a revolution in the way that shoppers behave, and that in turn is creating a revolution in retail, and in marketing. Do your marketing efforts really create customer value? If you’d like to know, please get in touch.

Image: Flickr